D8 - The Surplus That's Going to Crush our Debt

- Joe Debt

- Nov 17, 2025

- 4 min read

Updated: Dec 2, 2025

We believe that our monthly income less our monthly expenses—the surplus—is where the "magic" lies.

Understanding Our Monthly Income and Expenses

A quick recap from a previous blog D1 - The Plan We're Using to Crush Our Debt for Good.

In that post, we stated:

First, we will compile a monthly income statement, just like any business would, to determine if we have a profit or a loss—or, more relevantly, a surplus or deficit.

The Importance of Knowing Our Surplus

Before we dive into finding out what our surplus is, let’s remember the true cost of our debt. From a previous post The Shocking Cost of Our Debt, we learned it is roughly R8,618 per month. We only consider the interest part of our debt as an expense. In other words, we don't see the monthly payment towards our debt (credit cards, loans, overdrafts, etc.) as an expense, but rather only the interest portion. All of that was explained in the post above (go to that link above to read/re-read it).

Next, we will add all our monthly expenses (including the income expense - R8,618) together. We will then subtract that from our combined income to arrive at either a deficit—where our expenses exceed our income—or a surplus—where our income exceeds our expenses.

Our Current Household Monthly Income Statement

Here is a screenshot of our actual "household monthly income statement" as it stands at the moment, which, fortunately for us, shows that we have a surplus:

If you look at the table above, you will see the interest expense (R8,618) listed on our monthly income statement. This is not the total of all the monthly payments we make to our debt (credit cards, or bank loans, etc.). Why? Because the monthly payments are not the "real" expense—the interest on the money owing is.

What’s Our Monthly Surplus?

R4,605

Technically speaking, this is the amount we should be able to reduce that big outstanding debt with every month—the capital portion.

The Payment Process Explained

The process is as follows (as an example):

During the month, you have a balance, let’s say ours is R470,000.

At the end of the month, we make a payment which is the R8,618 (interest and account fees) plus the R4,605 (the surplus).

At the same time, the financial institutions (banks and stores) add back the monthly interest, which is roughly the same as the R8,618.

The sum then looks like this: 470,000 - 8,618 - 4,605 + 8,618 = 470,000 - 4,605 (this is an oversimplified example).

You can download a free blank template of the spreadsheet that we used here. Please remember that if you have a partner and treat all your income and expenses as "one," then you need to combine it on the spreadsheet—same as we have. The template is only available in Excel at this stage, so I think you would only properly be able to use it on a laptop or desktop.

If you take all the debt we owe (say R470,000) and divide that amount by R4,605 (the amount we are reducing the capital amount by every month, as explained above), then the sum looks like this:

445,000 divided by 4,605 = number of months it will take us to pay off our debt.

In this case, 445,000 / 4,605 = 96.6 months. Divide that by 12 to get years = 8 years.

Sheesh, that's a long time. We'll be about 60 years old by then and only able to start saving and investing for retirement.

The Power of Compounding in Our Favor

But here's the magic! We now know that we can afford to pay R8,618 (the interest) + R4,605 (our surplus) = R13,223 every month, right? We've budgeted for this. But as soon as the capital amount starts decreasing, so does the interest. It's like the power of compounding—but, IN OUR FAVOR.

As an example, when the capital amount (debt owing) is halfway, say R222,500, the interest will be more or less R4,319 per month (ignoring account fees) — half of the R8,618 we mentioned above. So, do we still only pay our surplus of R4,605 every month? No! We will still be paying the R13,223, but the difference is that now only R4,319 is the interest portion, and R8,904 is the surplus that goes toward the capital amount every month.

Visualizing the Impact

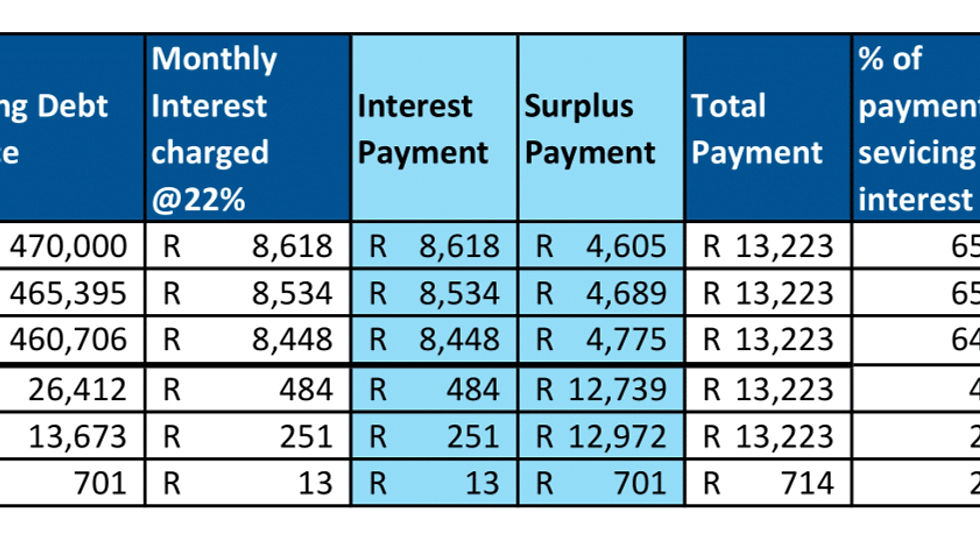

Check it out:

From the above, you can see that if we keep the total payment the same each month (R13,223 or whatever you calculate your amount to be), then the percentage of your payment going towards the interest portion becomes a lot less as the months go by. It started as 65% and ended at 2% at month 58.

The Benefits of Consistency

Also, it's worth noting that because we kept the payments the same every single month (R13,223) and not just our calculated surplus plus whatever the monthly interest worked out to be for that month, instead of paying off the loan in 8 years, we will pay it off in 59 months (almost 6 years).

If you can add any extra to this monthly payment from either a salary increase or a side hustle, etc., then things can start looking very promising for us.

Next Steps: Choosing a Debt Repayment Method

Next, let’s talk about which method we'll be using—the SNOWBALL or AVALANCHE method—and how to apply the SURPLUS amount to that method each month.

Until then, take financial care.

Comments